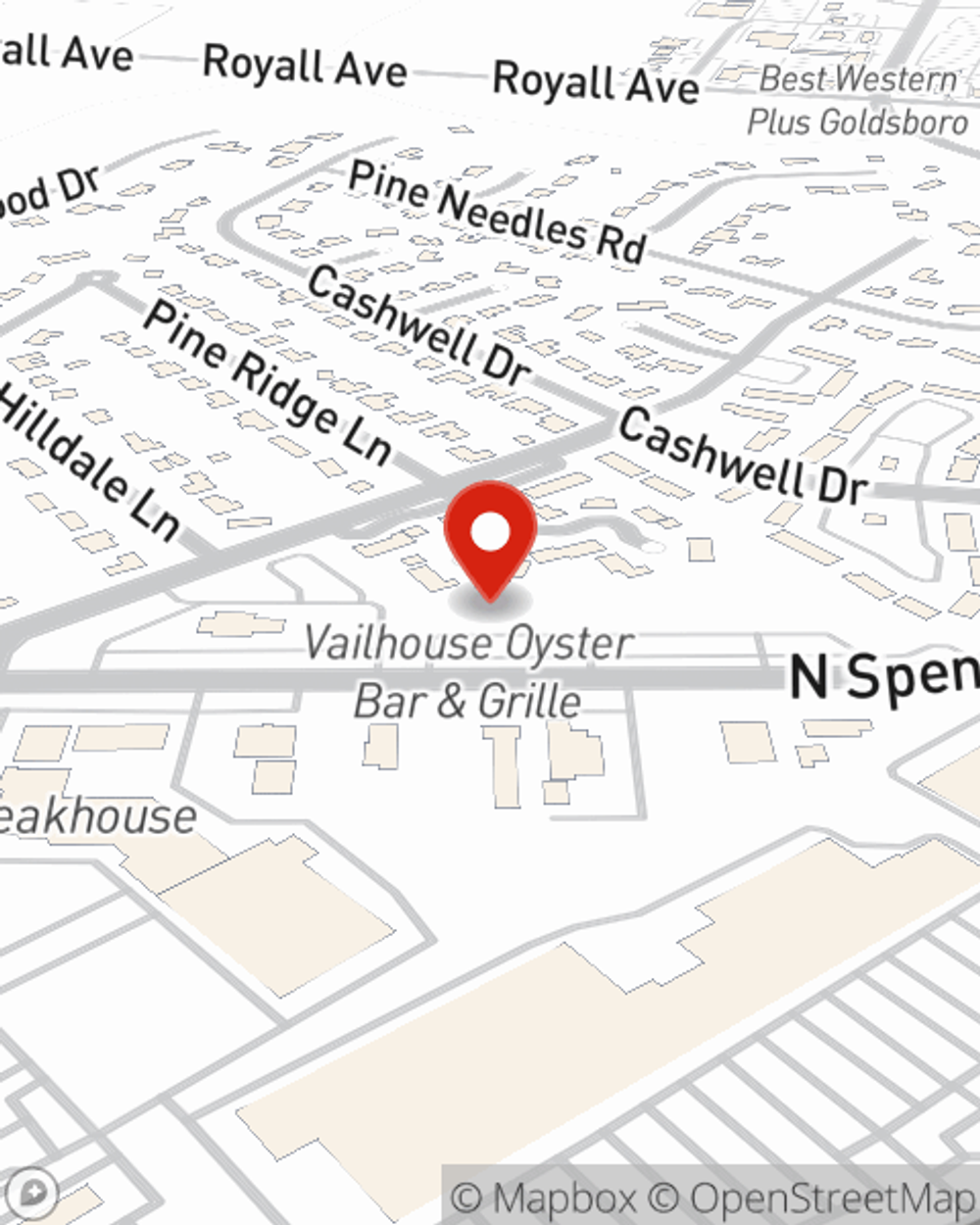

Business Insurance in and around Goldsboro

Searching for insurance for your business? Look no further than State Farm agent Melissa Throm!

This small business insurance is not risky

Cost Effective Insurance For Your Business.

Small business owners like you have a lot on your plate. From HR supervisor to financial whiz, you do whatever is needed each day to make your business a success. Are you an electrician, a real estate agent or a surveyor? Do you own a donut shop, a beauty salon or a pizza parlor? Whatever you do, State Farm may have small business insurance to cover it.

Searching for insurance for your business? Look no further than State Farm agent Melissa Throm!

This small business insurance is not risky

Strictly Business With State Farm

Your business thrives off your commitment determination, and having fantastic coverage with State Farm. While you make decisions for the future of your business and lead your employees, let State Farm do their part in supporting you with artisan and service contractors policies, worker’s compensation and commercial liability umbrella policies.

The right coverages can help keep your business safe. Consider calling or emailing State Farm agent Melissa Throm's office today to review your options and get started!

Simple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Melissa Throm

State Farm® Insurance AgentSimple Insights®

ATV safety tips

ATV safety tips

Taking the proper ATV safety steps can help keep you and your family safe while you enjoy your riding experience.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.